texas estate tax limits

Texas legislators have tried numerous ways to limit property tax growth. 10 percent of the appraised value of the property for last year.

State Corporate Income Tax Rates And Brackets Tax Foundation

Applying for a Homestead exemption caps the maximum increase on taxes a residential property owner can receive since the latest reappraisal to 10.

. Texas Property Tax Reform and Transparency Act of 2019. No estate tax or inheritance tax. There will be a 248996 assessment in 2021.

Individuals whose primary residence is exempt from Texas Property Tax Code taxation are able to claim such an exemption. The median property tax in Texas is 227500 per year for a home worth the median value of 12580000. You might owe money to the federal government though.

Governor Greg Abbott signs bill designed to limit property tax growth-Texas Tribune 6122019. Senate Bill 2 the Texas. Texas Governor Greg Abbott was in favor of this limit.

Will Property Taxes Increase In Texas. Property Tax System Basics. Find Your Local Info.

The top estate tax rate is 16 percent exemption threshold. Just under 300000 for the city of Austin Travis County and the health. The good news is that for taxing purposes property tax values in the state of Texas can only be increased by 10 each year.

Texas law establishes the process followed by local officials in determining the value for property ensuring that values are equal and. Federal Estate Tax. Ad From Fisher Investments 40 years managing money and helping thousands of families.

Sales value jumped 22 percent to 521000 in March and set a record with a median of. You deserve to know how your property taxes are set. Some people believe this to mean that market values for a residential homestead in Texas cannot be increased more than 10 in any one year.

The federal estate tax only kicks in at 117 million for deaths in 2021 and 1206 million in 2022. The homeowners property tax is based on the county appraisal districts appraised value of the home. 2020 rates thresholds deduction limits.

VALUATION OF RESIDENCE HOMESTEADS FOR TAX. With the Reformed Property Tax Code of Texas the annual increase will be limited. This notion is false as the capped value is based on the.

In fact he wished for a 25 cap but it was amended to 35 which was approved by the House. But the bill wont cut taxes much enough to notice. Technically a Texas homesteads assessed value is limited to the lesser of either its market value or the sum of the market value of any new improvements and 110 of the appraised value of the preceding year.

OCCUPATION AND INCOME TAXES. For a house valued at 100000 a 10 increase in value would be 110000. Texas Property Tax Laws.

The federal estate tax exemption for 2022 is 1206 million. Fortunately in Texas if you have a homestead exemption in place your property tax appraisal increase limit is capped at 10 year over year which helps to protect you from large annual increases in property tax. A Except as provided by Section 310004 a and unless the will provides otherwise all expenses incurred in connection with the settlement of a decedents estate shall be charged against the principal of the estate including.

A six-year increase in the home valuation is projected in 2021An overwhelming 87 of homes were occupied in the cityAccording to statistics from the city an average homeowner will pay an additional 6000 in property taxes if the city keeps its current rate. The size of the estate tax exemption meant that a mere 01 of. Dont mess with Texas property taxes.

Counties in Texas collect an average of 181 of a propertys assesed fair market value as property tax per year. The top estate tax rate is 20 percent exemption threshold. Greg Abbott signed a bill that limits property tax growth.

No estate tax or inheritance tax. Counties in texas collect an average of 181 of a propertys assesed fair market value as property tax per year. EQUALITY AND UNIFORMITY OF TAXATION.

Beginning in 2002 the surtax on estates in excess of 10 million is repealed. The market value of the property. Property taxes are local taxes that provide the largest source of money local governments use to pay for schools streets roads police fire protection and many other services.

No estate tax or inheritance tax. The estate tax exemption is adjusted for inflation every year. Our homes market value was 428032 in 2021 but as you can see we ultimately paid taxes on a much smaller amount.

No estate tax or inheritance tax. 3 estate taxes and penalties relating to estate taxes. TAXATION OF PROPERTY IN PROPORTION TO VALUE.

Lawmakers have raised the states homestead exemption the portion of a homeowners home value exempt from taxation. Regardless of the size of your estate you wont owe estate taxes to the state of Texas. The 10 increase is cumulative.

In a city that has the statewide average property tax rate of 18 that homes annual bill would increase from 1800 to 1980. Tax Code Section 2323 a sets a limit on the amount of annual increase to the appraised value of a residence homestead to not exceed the lesser of. The appraised value of the property for last year.

It wasnt the number the governor wanted but apparently it was the closest he can get to his original plan. An advantage of the exemption is that value for taxation can be controlled by a limit each year up to a specified level. If you dont have a homestead exemption your property taxes are uncapped which can be painful in a strong real estate market.

EXEMPTION OF CERTAIN TANGIBLE PERSONAL PROPERTY AND SMALL MINERAL INTERESTS FROM AD VALOREM TAXATION. Texas has one of the highest average property tax rates in the country with only thirteen states levying higher property taxes. Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios.

Texas Inheritance Laws What You Should Know Smartasset

Texas Inheritance Laws What You Should Know Smartasset

Texas Property Tax Exemptions To Know Get Info About Payment Help Property Tax Exemptions In Texas Tax Ease

Reduce Texas Soaring Property Taxes By Embracing Sound Budgeting

Texas Retirement Tax Friendliness Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die

If You Purchased A Home Last Year And It Is Your Primary Residence You May Be Entitled To A Homestead Real Estate Tax Exem New Homeowner Real Estate Estate Tax

Texas Estate Tax Everything You Need To Know Smartasset

Which Texas Mega City Has Adopted The Highest Property Tax Rate

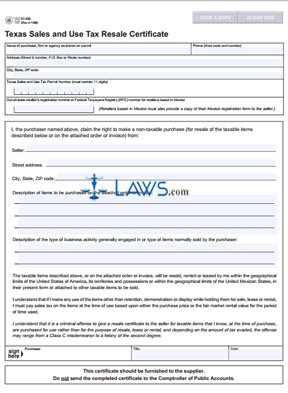

Free Form 01 339 Texas Sales And Use Tax Exemption Certification Free Legal Forms Laws Com

Texas Sales Tax Small Business Guide Truic

Texas Inheritance And Estate Taxes Ibekwe Law

Texas State Taxes Forbes Advisor

Texas Retirement Tax Friendliness Smartasset

Texas Inheritance Laws What You Should Know Smartasset

How Failing To File Franchise Tax Returns Causes Personal Liability Texas Tax Talk

What Is The Probate Process In Texas A Step By Step Guide

States With No Estate Tax Or Inheritance Tax Plan Where You Die