direct vs indirect cash flow forecasting

It is a simple way of calculating your cash flow and can be done quickly from data readily available in your accounting software. Generally companies start with direct cash flow forecasting to understand their daily cash movements.

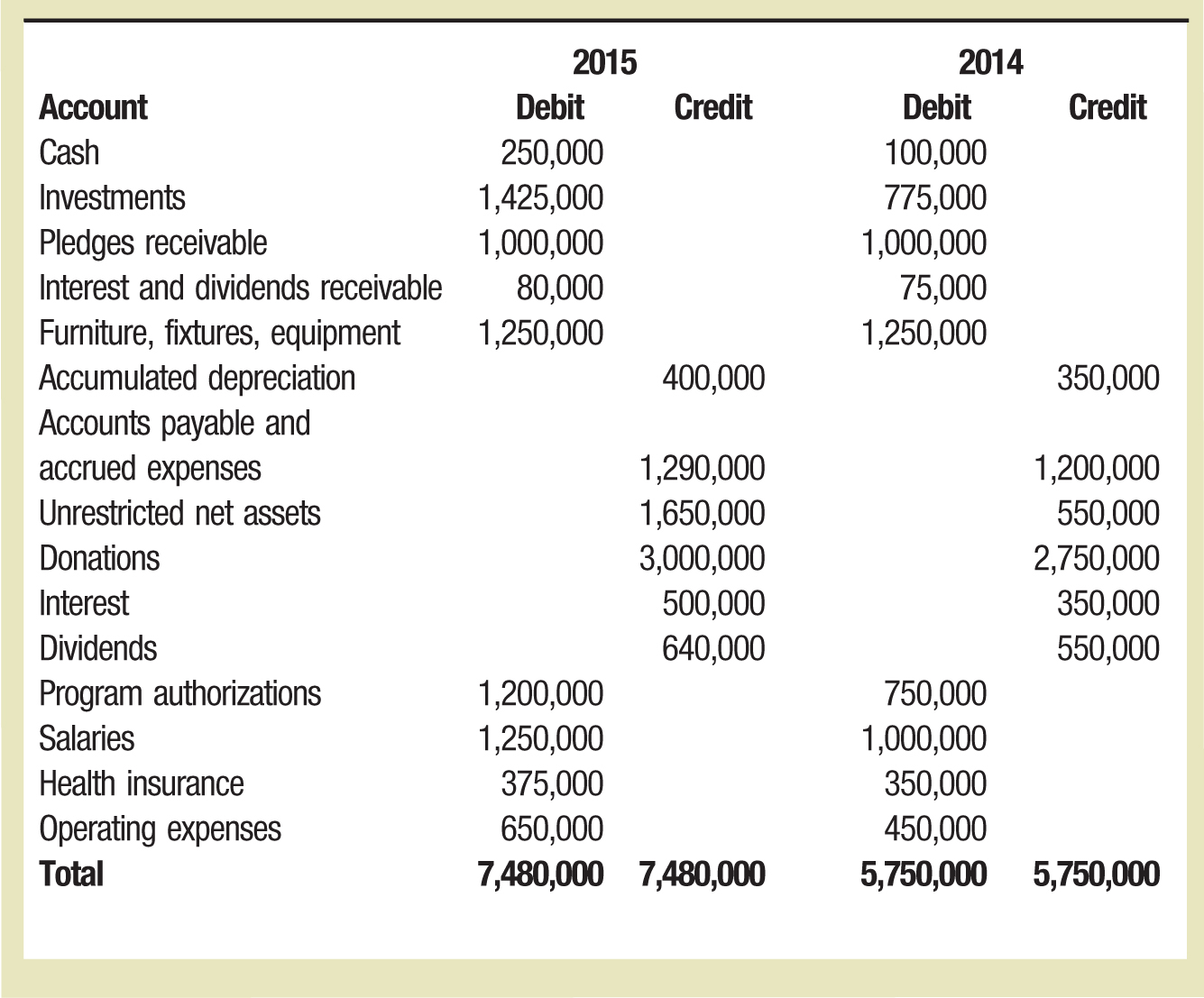

Direct Vs Indirect Cash Flow Methods Top Key Differences To Learn

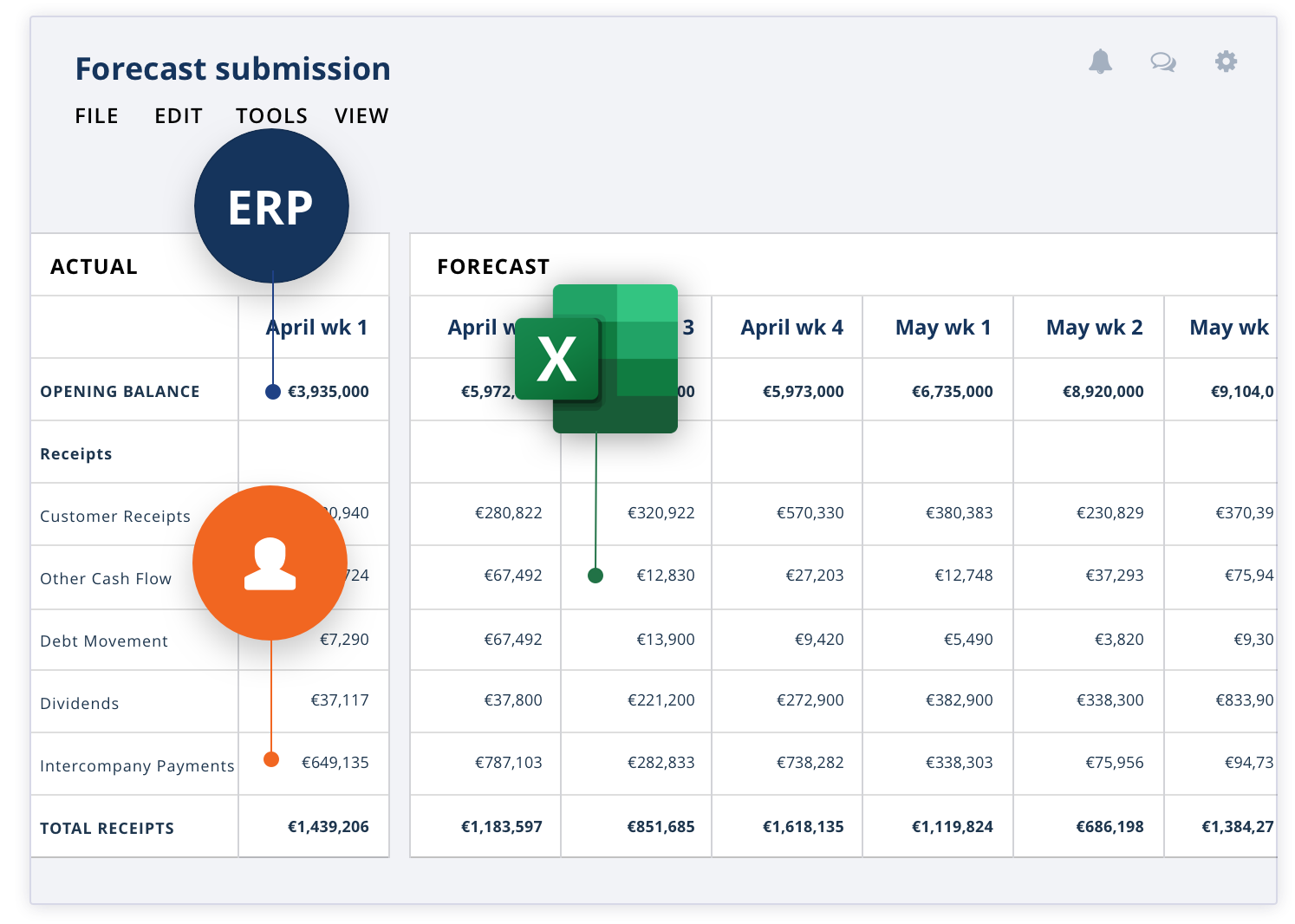

Screen grabCFO Dive.

. For both direct and indirect cash flow statement preparation you prepare the financing and investing portions in the same way. Statement of cash flows can be prepared and presented by two methods namely direct method and indirect method. Get driver-based cash flow forecasting and scenario analysis to fit your requirements.

Obviously the direct method for calculating the net cash flow is not only less time consuming when comparing direct vs indirect cash flow methods but also more informative for analyzing cash flows since it makes it possible to get a more complete picture of their amount and composition allowing to determine not only the net cash flows by type of activity but also. The indirect method takes net income as the basis for calculation and requires you to make adjustments to this according to items that are excluded from the profit and loss statement. Indirect cash flow forecasting Expand All What is direct cash forecasting.

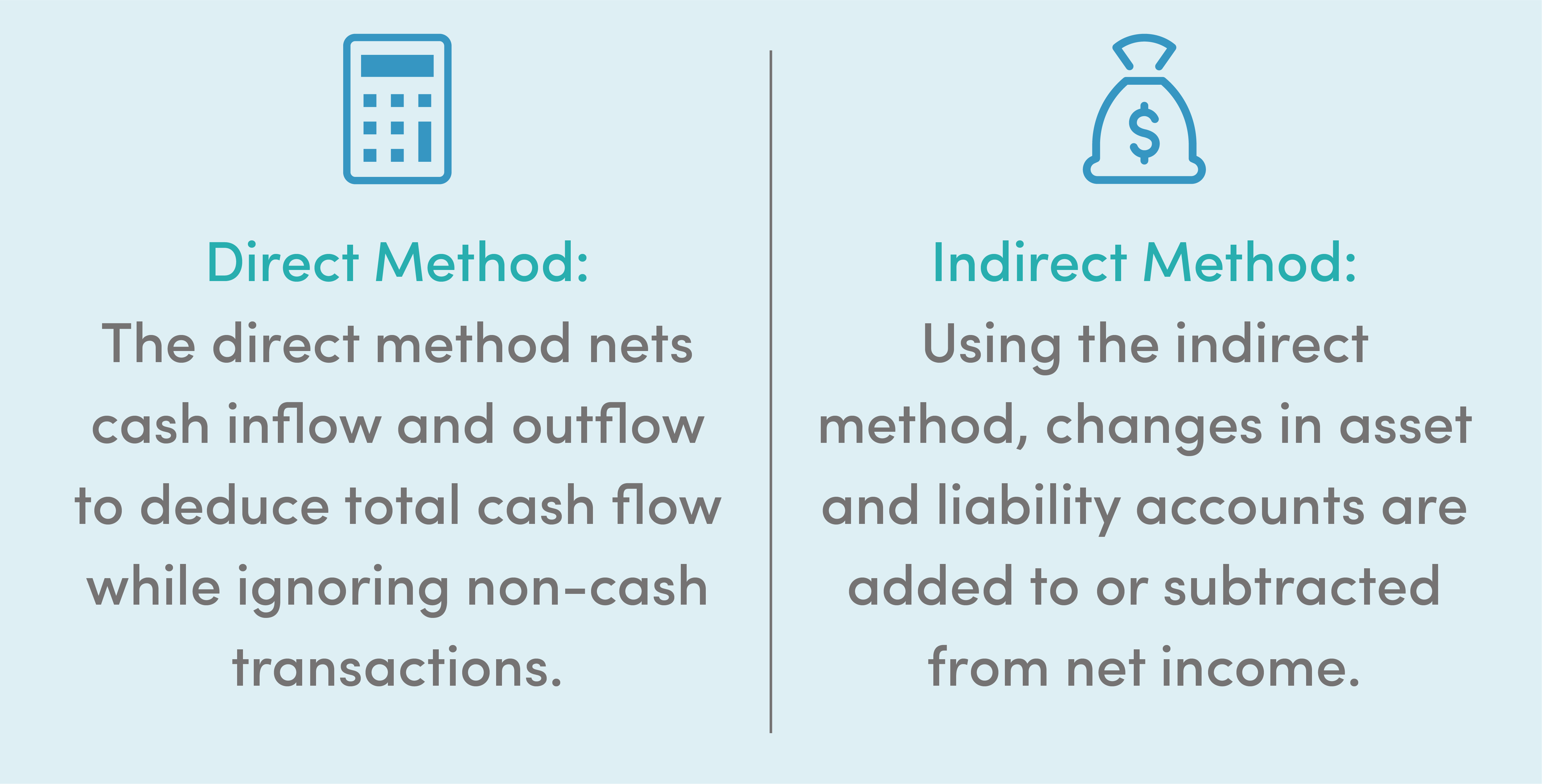

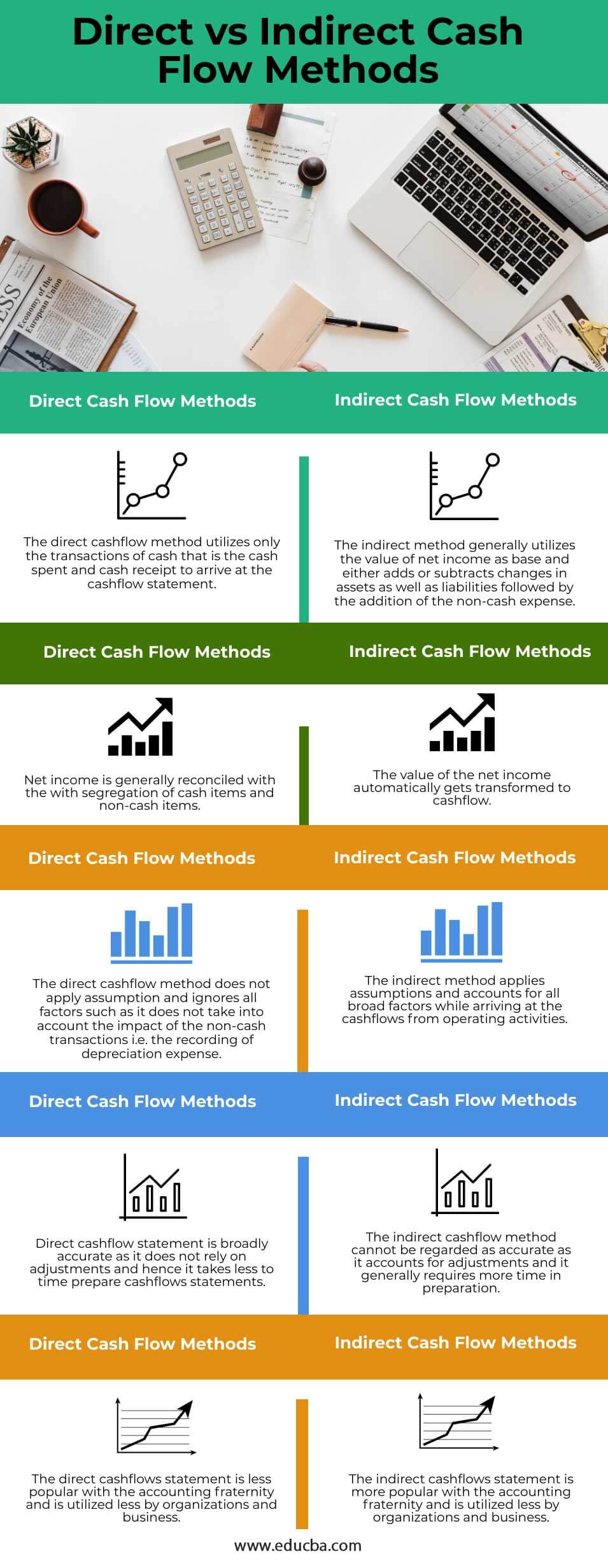

Main Difference between Direct and Indirect Method of SCF The main difference between the direct method and the indirect method of presenting the statement of cash flows SCF involves the cash flows from operating activities. The difference lies in the presentation of cash flows from operating activities. Whereas the direct method involves collecting information from bank transactions minusing cash income from cash expenditure to reveal your cash flow.

Direct cash forecasting or short-term forecasting shows cash positions at a specific time. These are called the direct and indirect method of cash flow forecasting. There are no differences in the cash flows from investing activities andor the cash flows from financing activities.

It is a simpler process that uses the balance sheet and profit and loss statements in order to predict cash flow. Thats a bottoms up approach that pairs real-time data from all of the companys bank accounts with its biggest cash flow items generally its submodel. The reason this method isnt very common is that it can become.

As you can see this method directly uses cash inflow and outflow to generate its output. So if the direct method is so accurate why would you use the indirect method. As a rule companies start out with direct cash flow forecasting to get an idea of daily movements.

The direct method on the other hand describes listing all your businesss cash inflows and outflows during the defined period. The direct method ideal for shorter periods identifies all likely future inflows and outflows. Generally speaking the indirect method is easier to use.

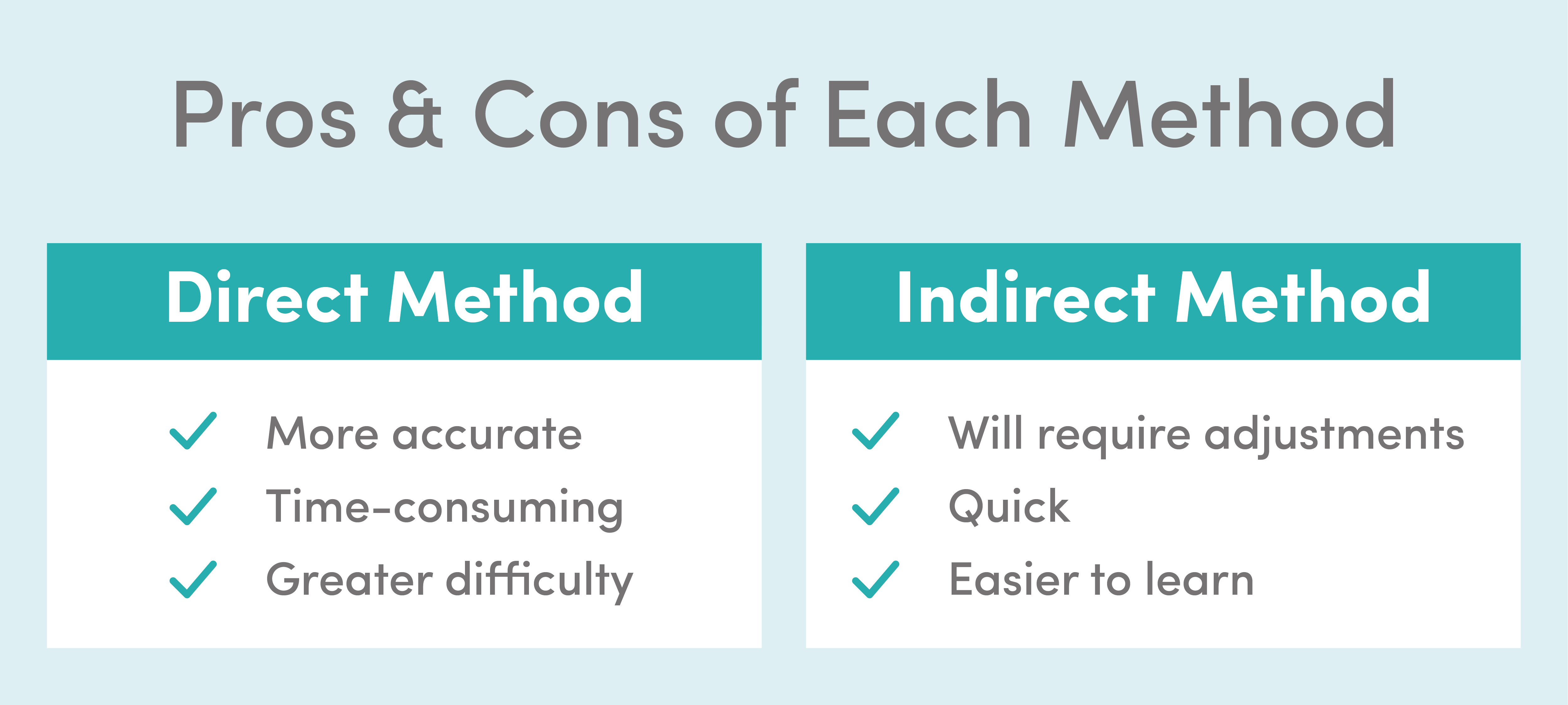

The key differences between the Direct vs Indirect Cash Flow Methods are as follows. When reporting income this only takes into account money that has actually been received by the firm meaning it directly reflects the actual cash a company has to hand and when this is coming in and out of the business. The indirect method is relatively complex method as compared to the direct method as it utilizes net income as the base and performs necessary cashflow adjustments.

Forecast your future cash position and regain your control on your business finances. One of the adjustments can be regarded as the treatment of non-cash expenses. Cash flow receivables - expenditures.

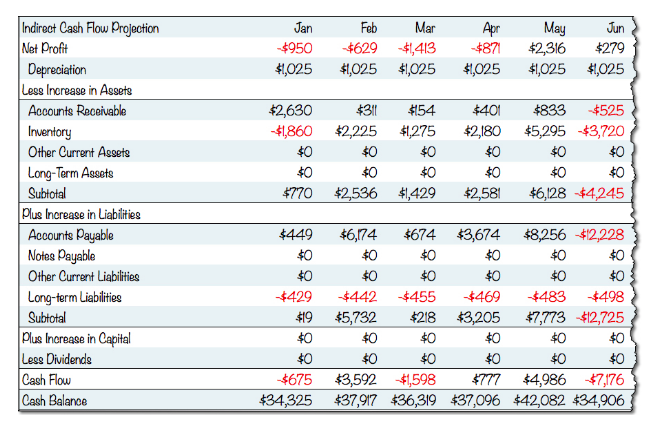

Direct forecasting can be quite accurate while indirect forecasting yields increasingly tenuous results after not. The indirect method which is best for longer terms uses forecasts from other financial statements. Building a cash flow statement with the indirect method Set up the statement First record the net income for your defined period.

Eventually they switch to indirect cash flow forecasting as the company expands or plans for acquisitions. This is because it uses adjustments where the direct method does not. Indirect Cash Flow Forecasting You can perform a cash flow forecasting using either the direct or indirect method.

Because of the importance of an accurate cash picture CFOs and treasurers typically rely at least informally on whats known as direct cash flow forecasting. Ad Optimize cash shore up your capital position extend your runway for business resilience. Moreover each business is different and may prefer a certain way.

Its also important to note that the accuracy of the indirect method is slightly less than the direct method. Whereas the direct method will only focus on the cash transactions and produces the flow from the operations of your business. This helps them to identify borrowing or investment opportunities.

The direct cash flow forecasting formula is exactly what you would expect. In fact its the only feasible way of producing a cashflow forecast manually its too difficult to model any volume transactions by hand so in the past most finance people have relied on the indirect method. The indirect method is widely used by many businesses.

Its also called the receipts and disbursements method. This then helps you identify your businesss net cash flow from operating activities. The near-term forecasting is known as direct forecasting while the longer-term forecasting is known as indirect forecasting.

The direct method of cash forecasting is useful for up to around three months. So whats the difference between direct and indirect. While both are ways of calculating your net cash flow from operating activities the main distinction is the starting point and types of calculations each uses.

The indirect method begins with your net income. The indirect method on the other hand focuses on net income and may include cash that is not yet in the business. Eventually youll need to switch to indirect cash flow forecasting as your company expands.

The indirect method The indirect method of cash flow forecasting is more widely used amongst businesses. Ad Download our toolkit to learn how to forecast cash flow statements even in uncertain times. The direct approach affects only the cash flow statements operations section while the cash flow from the investing and financing sections will be similar regardless of whether an indirect or direct method is utilized.

As you are simply making a few adjustments to one figure you can arrive at your final figure much quicker than the direct method. In both methods there is no difference in cash flows from investing activities and cash flows from financing activities. The direct and indirect methods of cash flow forecasting affect the cash from operating activities section of cash flows and not cash from investing activities or.

The direct method includes all types of transactions including credit and cash transactions as well as bills invoices and tax. The direct method is less commonly used but much easier to calculate. This is an essential part of measuring day-to-day cash flows and knowing whether to buyborrow investment opportunities.

Can Quickbooks Report Cash Flows Using A Direct

Direct Vs Indirect The Best Cash Flow Method Vena

How Direct Cash Flow Models Help Predict Liquidity Wsj

Preparing The Statement Of Cash Flows Using The Direct Method The Cpa Journal

Printable Free Cash Flow Forecast Templates Smartsheet Cost Forecasting Template Pdf Cash Flow Budget Forecasting Personal Finance Budget

Preparing The Statement Of Cash Flows Using The Direct Method The Cpa Journal

Preparing The Statement Of Cash Flows Using The Direct Method The Cpa Journal

Differences Between Direct And Indirect Cash Forecasting Cashanalytics

The Direct And The Indirect Method For The Statement Of Cash Flows Online Accounting

Free Cash Flow Statement Templates Smartsheet Cash Flow Statement Spreadsheet Template Cash Flow

Statement Of Cash Flows Significant Non Cash Activities Accounting Classes Cash Flow Statement Bookkeeping Business

Statement Of Cash Flows Cash Flow Statement Positive Cash Flow Cash Flow

Cash Flows Operating Activities Direct Vs Indirect Method Accounting Financial Tax

Methods For Preparing The Statement Of Cash Flows Cash Flow Statement Cash Flow Accounting Basics

Direct Vs Indirect Cash Flow Methods Top Key Differences To Learn

Differences Between Direct And Indirect Cash Forecasting Cashanalytics